7 Brutal Money Habits Keeping You Broke (No Matter How Much You Earn)

Discover the 7 brutal money habits that keep you broke—even with a high income. Learn how to break free from financial self-sabotage and start building real wealth today.

Many people blame their financial struggles on external factors—bad luck, the economy, or even "village people." But the truth? Your habits are the real reason you stay broke.

No matter how much you earn, certain behaviors will keep you trapped in a cycle of financial frustration. Here are the 7 brutal truths you need to hear—and fix—to escape poverty for good.

1. Living for “What Will People Say”

You buy things you can’t afford, throw parties to impress people, and wear designer shoes while your bank account screams for help.

- Reality Check: The people you’re trying to impress won’t pay your bills when you’re broke.

- Fix It: Stop flexing for strangers. Build real wealth, not a fake image.

2. Being a Walking ATM for Friends & Family

Every time someone says “Bros, help me small,” you send money—even when you’re struggling.

- Reality Check: You’re not a bank. If they won’t save for you, why are you their emergency fund?

- Fix It: Learn to say NO. Protect your finances.

3. Dating Above Your Income Level

You earn $20k/month but date someone who expects iPhones, luxury dinners, and $60k hairstyles.

- Reality Check: You’re not dating—you’re funding someone else’s lifestyle.

- Fix It: Date within your means or grow your income first.

4. Chasing “Get Rich Quick” Schemes

Instead of building skills, you’re buying fake forex courses, betting on sports, or joining Ponzi schemes.

- Reality Check: Quick money disappears faster than it comes.

- Fix It: Invest in real skills and long-term assets.

5. Being a Professional “Occasion Attendee”

Every weekend, you’re at a wedding, birthday, or naming ceremony—buying aso ebi, gifts, and drinks.

- Reality Check: You’re celebrating others while ignoring your own financial growth.

- Fix It: Prioritize your future over social obligations.

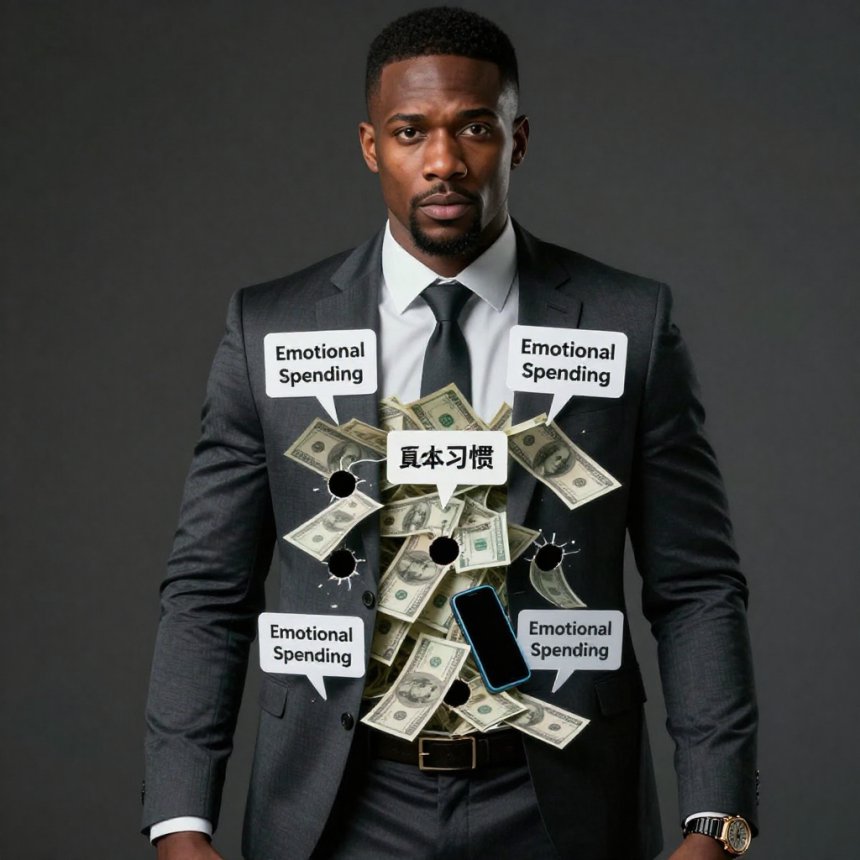

6. No Budget + Impulse Spending

You get paid, spend recklessly, and by month-end, you’re broke again.

- Reality Check: Money disappears when you don’t track it.

- Fix It: Create a budget. Save before spending.

7. Praying Without Planning

You say “God will provide” but waste money, ignore investments, and expect miracles.

- Reality Check: Even God rewards wisdom, not carelessness.

- Fix It: Plan, invest, and take action—don’t just pray.

Final Truth: Poverty Is a Habit

Broke isn’t just about low income—it’s about bad financial habits. Even $1 million/month won’t save you if you keep these behaviors.

How to Fix It:

✔ Budget ruthlessly.

✔ Cut off financial leeches.

✔ Stop flexing for people who don’t care.

✔ Invest before spending.

Wealth isn’t luck—it’s discipline. Start today.

Share

What's Your Reaction?

Like

1

Like

1

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0